As the number of Zilch sign-ups continues to soar, many are comparing the exclusive BNPL scheme to Klarna and Amex.

As buy now pay later (BNPL) schemes gain popularity amid the COVID-19 pandemic, consumers around the world are opting for these solutions to spread their payments when shopping online.

Typically, the most reputable providers don’t charge interest or fees, making low- and high-value purchases of all kinds accessible to low-income shoppers. For these people, purchases that were once out of budget are suddenly accessible – a huge step forward for the e-commerce industry.

I find that the main benefit, for both shoppers and investors, is that BNPL schemes are less risky than credit cards, which can lead to huge build-ups in interest payments and late fees. Meanwhile, BNPL solutions allow customers to sidestep this problem. Now, many shoppers are opting for BNPL schemes over credit cards, enjoying their higher level of protection and ease of accessibility.

While shoppers of all ages are shifting towards BNPL schemes, it’s the Millennials and Generation Z that are driving this shift. Younger generations are also limited when it comes to securing sustainable credit options. BNPL schemes are amongst the safest ways to shop using credit. As a result, Compare The Market concludes that – since the beginning of the UK lockdown – almost a quarter of 18-24 year-olds are likely to use BNPL schemes to fund their shopping.

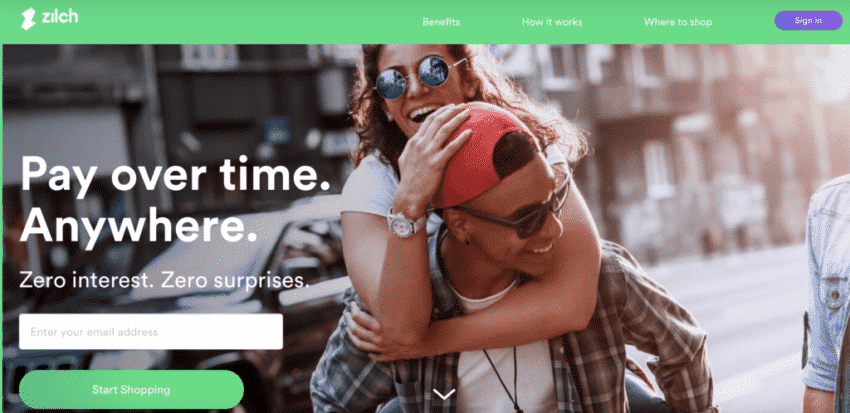

Whether you’re shopping for electronics, household essentials, clothing, or pet supplies, BNPL schemes can make shopping a whole lot easier. But with so many schemes up for grabs, it can be difficult to know which to opt for. I’ve recently been drawn to Zilch – a new player in the market with a fresh approach to the BNPL landscape. As Zilch has established a strong position in the market over the last year, many have compared the BNPL firm to Klarna and Amex. But what makes them different, and which solution is best for you?

Here’s how I’ve found Zilch’s up-and-coming solution compares to Klarna and Amex.

Is Zilch the New Klarna?

Klarna is one of the most established and largest BNPL systems in Europe. The Swedish firm supports a vast array of e-commerce stores and offers shoppers a range of payment plans to suit all. From direct payments to pay-after-delivery options and instalment plans depending on purchase type, shoppers can use Klarna to suit their specific financial situations. Klarna doesn’t charge interest but does charge late fees and these can add up.

Zilch protects shoppers by promising never to charge hidden fees of any kind (including late fees). Safe in the knowledge that Zilch won’t charge interest or late payments, shoppers simply pay for 25% of their purchase up-front. They can then split the rest of the amount due into four easy payments, which they can spread over six weeks. This way, Zilch allows shoppers to break payments down into small chunks without tying them into long-term repayment plans.

Praised for its exclusivity and ease of use, Zilch also provides the first over-the-top BNPL scheme that enables consumers to spread payments when shopping with any e-commerce store that uses MasterCard. Zilch’s virtual ‘MasterCard’ has made the BNPL system one of the most popular in today’s online climate. Shoppers don’t have to enter any card details when paying and will soon be able to ‘tap and pay’ in-store, too.

‘Our unique over-the-top approach to BNPL has been built out of our strong knowledge for instalment cards in developing economies such as South Africa and South America amongst others,’ says Philip Belamant, Zilch’s founder and CEO. ‘We combine the benefits of instalment and card products to offer the best way for our customers to pay overtime, anywhere. We believe that this generation should be able to responsibly have what they want when they want without being financially penalised for the privilege.’

Is Zilch the New Amex?

Though some compare Zilch to Klarna, I consider the new BNPL product closer aligned with American Express. As Zilch’s popularity skyrockets, interesting parallels between the companies are becoming apparent. Not only are Zilch and American Express both highly rated for outstanding customer service, but they both also partner with major digital wallet platforms to make checking out easier than ever when consumers shop with their favourite retailers. Both support Apple, Google, and Samsung Pay. These partnerships take the friction out of payment systems, which is key to both Zilch and Amex’s missions.

For shoppers who love rewards schemes, American Express and Zilch both offer a range of membership incentives to reward shoppers for their loyalty. Amongst these rewards, American Express awards Membership Reward points to shoppers who spend various increments within three months of setting up an account. Amex also awards one point for every pound that shoppers spend. Shoppers can then redeem their points when shopping with Amex’s huge range of retail partners. Meanwhile, Zilch rewards shoppers by allowing them to unlock new shopping features the more they use the system. As Zilch continues to develop its suite of rewards, account holders will enjoy an ever-growing selection of incentives exclusive only to Zilch.

Unlike Amex, Zilch never charges late fees or interest payments. Overall, Zilch customers save circa £350 on the interest and fees that are common with other schemes. They have over 5,000 retail affiliate partners, integrating some of the world’s biggest online shopping platforms. Many BNPL systems also rely on third parties to operate, but Zilch’s system is entirely independent and available to shoppers anywhere.

They also use AI and open banking to identify each shopper’s level of affordability and only fund low-value discretionary purchases. This is particularly important considering the current market conditions at the hands of Coronavirus and better yet, Zilch’s simple returns process is designed to avoid customer hassle and additional fees!

Having grown exponentially since launching its BETA system in 2019, over 30,000 customers sign up for a Zilch account every month. As a result, Zilch has closed more than a USD12-million in funding and will use the funds to scale its Zilch Boost feature to its waiting list of over 65,000 shoppers, which I think is well-worth signing up for as Zilch Boost allows shoppers to top up their funds to over £200 using funds from their bank account.

As the BNPL market evolves, thousands of shoppers are signing up for a virtual Zilch card to make their future payments quick and easy. As my new favourite BNPL product, Zilch’s groundbreaking payment system is redefining the e-commerce industry, both from consumer and investor perspectives.